Flood Insurance Claim Success

It was Monday 4th January 2016. The first working day back in the New Year.8.30am.

It was Monday 4th January 2016. The first working day back in the New Year.8.30am.

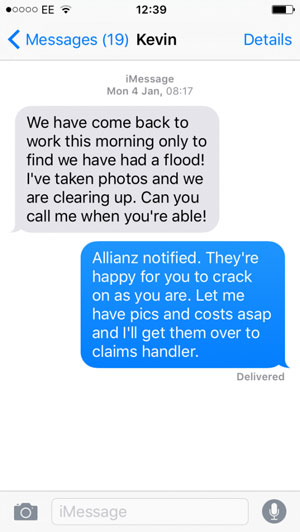

I received the text in the picture from my client. What a great start to the day?!

I phoned Kevin and chatted through what to do next. To his credit, he’d already started ‘acting as if uninsured’ a key principle of insurance. Basically, don’t just sit there doing nothing. Crack on and start minimising the damage instead.

One of Kevin’s employees was already on his way to the hire place to get some industrial dehumidifiers and the rest of the guys were drying and mopping as best they could. I told Kevin I’d let his insurers know what had happened and report back as soon as possible.

Needless to say, he was otherwise engaged when I called back, so I dropped him a line by text.

Within hours the guys were back working, testament to how well they’d mucked in. A little while later, Kevin had sent me as many pictures of the damage as possible and an itemised list of everything that had suffered damage. I forwarded all of this to the claims handler at his insurer.

We hit only one, minor, stumbling block when the insurers challenged the concept of paying his mens’ wages for the time they were cleaning up. After all, they were supposed to be at work anyway. But once I pointed out that they had been supposed to be making kitchens, not mopping floors, the insurers saw my point of view and were happy to settle that element of the claim as well.

All told, it took 8 days from notification to full settlement into Kevin’s bank account. A good result in my opinion and a demonstration of how insuring your business with a quality insurer via a Chartered Insurance Broker is the best way to go if you don’t want to have any issues when you claim.